Call Us Now

For a Free Quote

Call Us Now

For a Free Quote

Save Big on Auto Insurance

Compare & Save with Free, Fast Quotes

Save Big on Auto Insurance

Compare & Save with Free, Fast Quotes

We know there are many options available to you and there are many factors which can affect the type of coverage that is best for your personal needs. These factors can also affect the cost of your auto insurance. Our licensed and professional personnel are trained to offer you exceptional service and help you get the best cost for the coverage you need

Type of Coverages

Liability insurance

Bodily Injury/Property Damage Covers damage that you may cause to other people’s property or bodies in an accident.

Minimum limits allowed by the state to satisfy financial responsibility requirements are $15,000 per person (bodily injury), $30,000 per accident (bodily injury), $5,000 property damage.

Comprehensive insurance

Comprehensive Insurance covers damage to your vehicle from non-collision events (theft, fire, vandalism, etc.).

Medical Payments Coverage (MedPay) covers medical expenses for you and your passengers after an accident, regardless of fault.

MedPay is typically sold in increments of $1,000 to $25,000 and helps cover hospital visits, surgery, X-rays, ambulance fees, and funeral costs.

s not a substitute for health insurance or major medical coverage

Uninsured drivers

Minimum coverage allowed is $15,000 per person/$30,000 per accident. It is usually sold in the same limits as liability.

It protects you medically in the event of an accident with an uninsured motorist which results in injury to you.

You can collect from your own company. This is particularly important in the case of a hit and run driver.

You may claim on this coverage if you are injured by an uninsured motorist while driving, while riding a bicycle, or walking.

Mexico Auto Insurance

When going out of town or on vacation, you want your family to feel safe and secure which is why you can rely on Ruby’s Insurance to provide that for you and your family. We will find the right company that best fits your needs at an affordable rate.

We know there are many options available to you and there are many factors which can affect the type of coverage that is best for your personal needs. These factors can also affect the cost of your auto insurance. Our licensed and professional personnel are trained to offer you exceptional service and help you get the best cost for the coverage you need

Type of Coverages

Liability insurance

Bodily Injury/Property Damage Covers damage that you may cause to other people’s property or bodies in an accident.

Minimum limits allowed by the state to satisfy financial responsibility requirements are $15,000 per person (bodily injury), $30,000 per accident (bodily injury), $5,000 property damage.

Comprehensive insurance

Comprehensive Insurance covers damage to your vehicle from non-collision events (theft, fire, vandalism, etc.).

Medical Payments Coverage (MedPay) covers medical expenses for you and your passengers after an accident, regardless of fault.

MedPay is typically sold in increments of $1,000 to $25,000 and helps cover hospital visits, surgery, X-rays, ambulance fees, and funeral costs.

s not a substitute for health insurance or major medical coverage

Uninsured drivers

Minimum coverage allowed is $15,000 per person/$30,000 per accident. It is usually sold in the same limits as liability.

It protects you medically in the event of an accident with an uninsured motorist which results in injury to you.

You can collect from your own company. This is particularly important in the case of a hit and run driver.

You may claim on this coverage if you are injured by an uninsured motorist while driving, while riding a bicycle, or walking.

Mexico Auto Insurance

When going out of town or on vacation, you want your family to feel safe and secure which is why you can rely on Ruby’s Insurance to provide that for you and your family. We will find the right company that best fits your needs at an affordable rate.

Companies we partner with

Companies we partner with

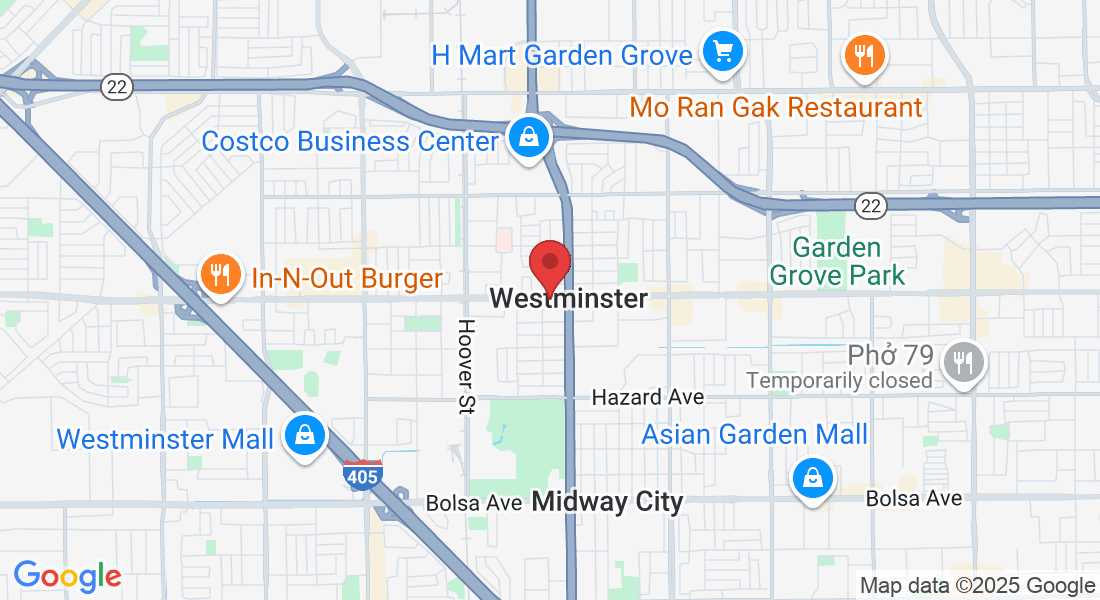

Get In Touch

Contact Us: (714) 893-2909

Email: [email protected]

Business Hours:

Mon - Friday 9:00 am - 5:30 pm

Sat - 10:00 am - 2:30 pm

Sunday - Closed

Get Links

Ruby's Insurance and Taxes Corp. ©2009 - 2025

Get In Touch

Contact Us: (714) 893-2909

Email: [email protected]

Business Hours:

Mon - Friday 9:00 am - 5:30 pm

Sat - 10:00 am - 2:30 pm

Sunday - Closed

Get Links